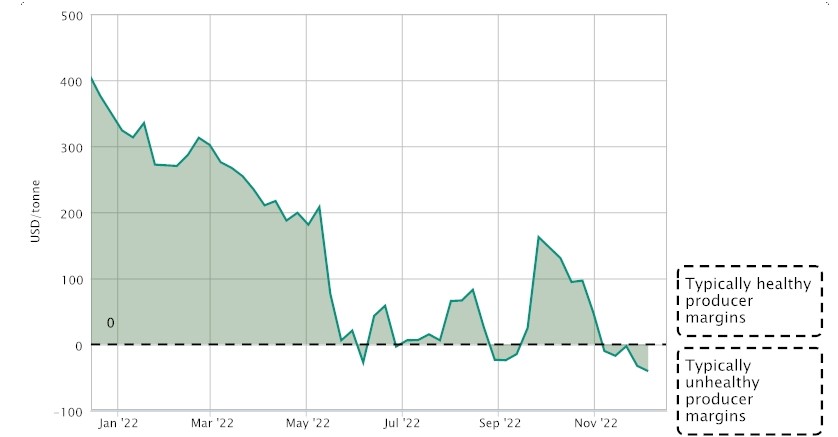

Asia ABS, SAN hopes in rally by Q2

Asia acrylonitrile-butadiene-styrene (ABS) and styrene acrylonitrile (SAN) players express hopes in a rally by Q2 2023 after a battering 2022, some two years since COVID-19 first broke out.

DEMAND AND CONSUMPTION

When COVID-19 first broke out, ABS, unlike many other petrochemicals, experienced a demand surge, due to its end-use applications.

About 80% of ABS is used in manufacturing household appliances, and about 10% in automobiles. SAN is largely used in consumer products including air conditioner and fan blades.

Many countries implemented lockdowns and movement controls, confining millions at home.

The demand for household appliances surged, and ABS enjoyed strong consumption and margins during 2020 and the earlier months of 2021.

However, going into 2022, lockdown measures were gradually eased, including in China which had been upholding its zero-COVID policies until early December.

During the course of the year, end-use demand in household appliances had dropped drastically.

“We saw retrenchment in end-product factories, [even] during the traditional peak,” said a Hong Kong-based trader.

ABS’ traditional peak is typically in September and October, ahead of the shopping events including Singles’ Day, Black Friday, Cyber Monday, Christmas and the New Year.

ABS CFR Asia NE

The total consumption in Asia and the Middle East is estimate around 7.35m tones down by more than 6.3% year on year.

However, consumption compared to 2022, is projected to rise by more 6.25% in 2023 and more than 15% in 2024, with hopes pinned on the stimulus measures from China.